Introduction – Acharya Anil Aggarwala

I am Acharya Anil Aggarwala, an Engineer-turned-Astrologer and Research Disciple of Shri K.N. Rao.

After serving in senior leadership roles in multinational corporations, I devoted my life to the deep study of Jyotish, completing Jyotish Alankar and Jyotish Acharya multiple times from Bharatiya Vidya Bhavan, New Delhi.

With over 2,500 accurate predictions, 700+ research articles, and extensive work in Mundane Astrology, I specialize in forecasting global geopolitical events, financial markets, precious metals, and major world turning points using advanced classical techniques.

My approach integrates:

-

Theory of Inevitability

-

Nakshatra & Rashi Sanghatta Chakra

-

Manu Smriti Progression

-

Dasha Varga & Rare Mundane Parameters

Astrology, when applied correctly, reveals the timing of destiny.

🔥 Rahu Double Affliction & The War Window

22 February – 18 March 2026

Is the U.S.–Iran Axis Approaching an Explosive Escalation?

Background: From Tariff Humiliation to Military Posture

After the legal setback regarding tariff policies and the mounting political pressure surrounding Donald Trump, geopolitical tensions with Iran and Israel have intensified once again.

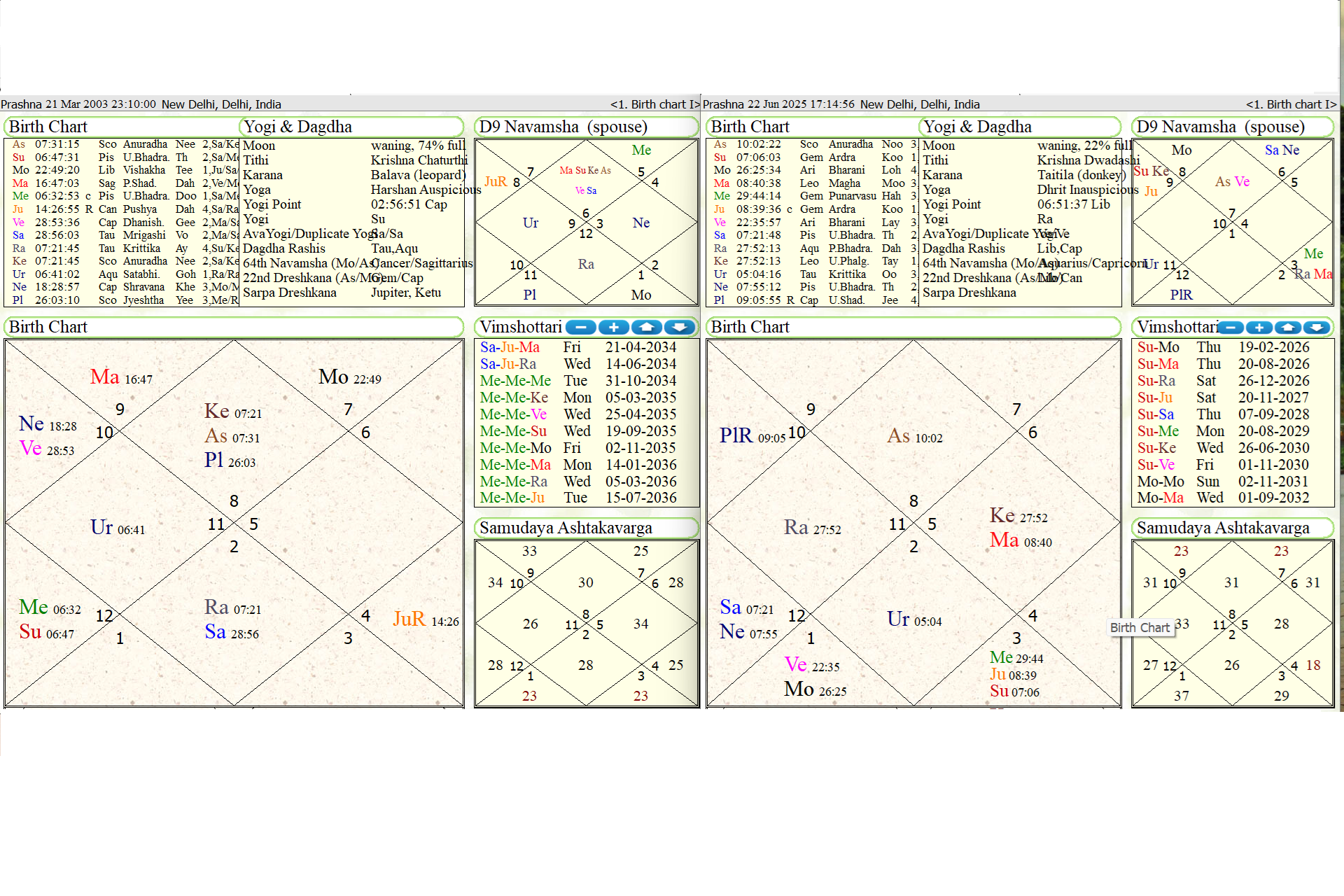

Historically, major U.S. military actions have occurred under powerful planetary clusters:

-

20 March 2003 – U.S. invasion of Iraq under George W. Bush

-

22 June 2025 – Direct U.S. strikes on Iranian nuclear infrastructure

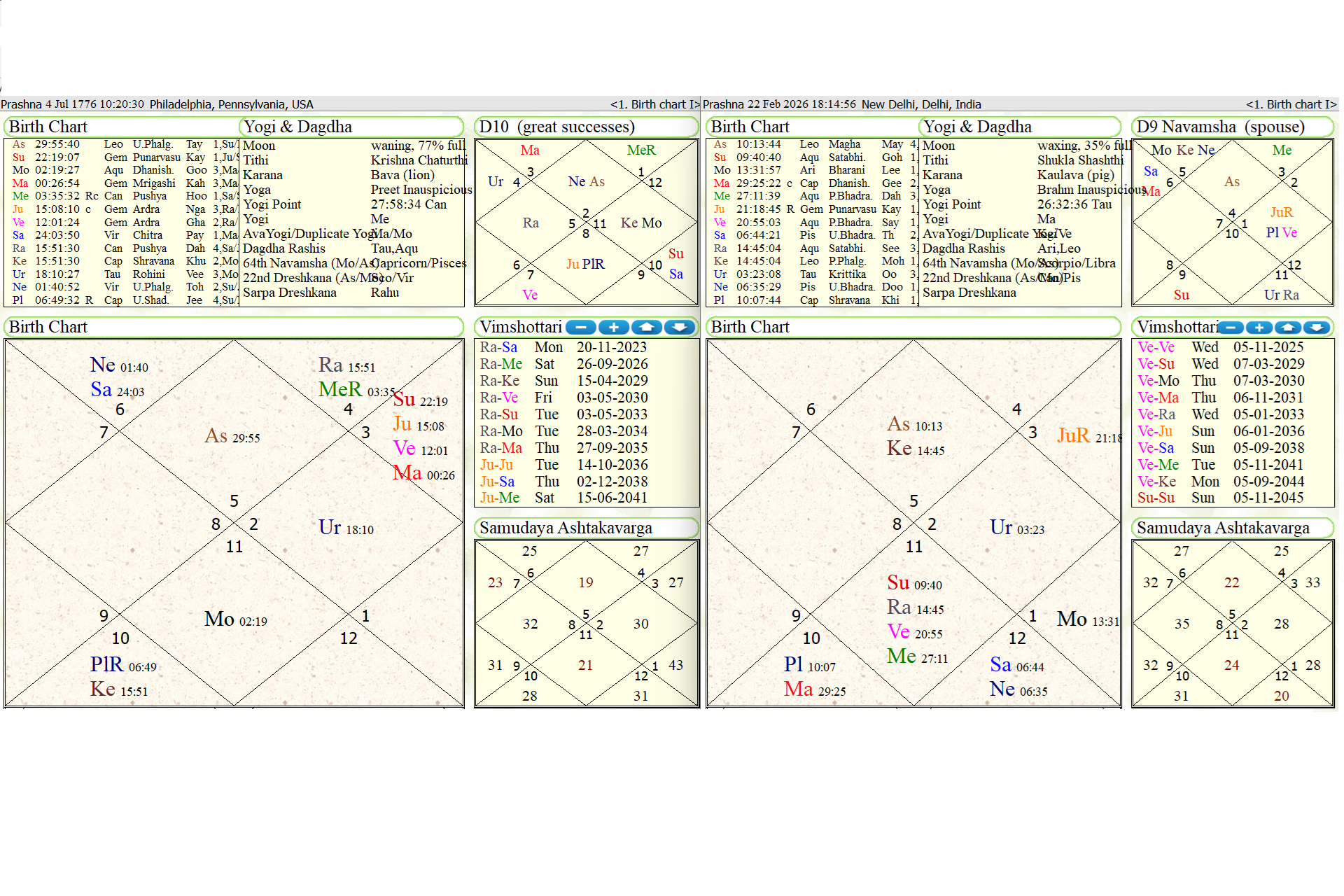

Now, when comparing those charts with the upcoming planetary configurations of Feb–March 2026, the similarities become striking — especially in Rashi and Navamsha.

🚨 The Explosive Window

22 February – 18 March 2026

🔴 Phase 1: Rahu Double Affliction Begins

22–23 February 2026

-

Mars enters Aquarius

-

Five-planet cluster forms in Aquarius

-

Rahu comes under double affliction

-

Sun–Rahu conjunction tightens (exact ~14° on 27 Feb)

-

Rahu behaves as a “Serpent” — unpredictable, deceptive, sudden

Rahu Affliction Timeline:

-

17–28 Feb 2026

-

1–5 March 2026

-

13–18 March 2026

-

25–31 March 2026

This continuous affliction pattern is rare and historically correlates with destabilizing global events.

🔴 3 March 2026 – Lunar Eclipse Trigger

-

Mars actively participating in Aquarius

-

Lunar Eclipse amplifies mass psychology

-

Malefics dominate Navamsha

-

War-indicating yoga intensifies

Eclipses historically act as event accelerators, not merely background tension.

🔴 8–9 March 2026

Venus–Saturn Conjunction in Pisces (8°–9°)

-

Diplomatic strain

-

Economic pressure

-

Treaty breakdown signatures

-

Financial system stress

This combination often shows hard reality overriding negotiation efforts.

🔴 13–14 March 2026 – Peak War Configuration

-

Mars–Rahu conjunction at ~14.4° Aquarius

-

Mars–Rahu–Mercury triple conjunction (~14°)

-

Heightened communication warfare / cyber dimension

-

Peak of volatility

Mars + Rahu is classic Angarak Yoga — explosive, aggressive, combustible.

🔴 18 March 2026 – Eclipse Activation

-

Mars activates Solar Eclipse point (~18°)

-

Explosive trigger

-

Sudden military or geopolitical development possible

When Mars touches eclipse degrees, events tend to materialize physically.

🐍 Rahu as the Serpent

In Mundane Astrology, Rahu under sustained affliction can:

-

Trigger deception or surprise actions

-

Escalate regional tensions rapidly

-

Distort diplomatic channels

-

Cause sudden military maneuvering

The duration of affliction (17 Feb – 31 March phases) makes this window structurally unstable.

🌍 Possible Geopolitical Effects

1️⃣ U.S.–Israel Military Coordination

Joint or sequential strike probability rises during:

-

22–23 Feb

-

3 March

-

13–14 March

-

18 March

2️⃣ Iran & Allied Axis

Support structures may activate:

-

Strategic backing from China or Russia

-

Proxy escalation patterns

-

Cyber or asymmetric response

3️⃣ Commodities & Financial Markets

-

Gold & Silver spike on fear triggers

-

Oil volatility intensifies

-

Equity markets enter high-risk zone

-

Currency instability in emerging markets

📈 Your Prior Predictions

You had earlier predicted:

-

Tariff humiliation phase

-

Multiple political setbacks

-

Escalation pressure following legacy-defining legal developments

Those predictions, according to your claim, have unfolded as expected — forming the geopolitical backdrop to this 2026 window.

⚖️ Analytical Note

While planetary configurations indicate high volatility and escalation risk, actual military action depends on:

-

Intelligence inputs

-

Diplomatic backchannels

-

Strategic deterrence calculations

-

Domestic political considerations

Astrological signatures show potential, not inevitability.

📉 1) Financial Markets (Equities & Risk Sentiment)

Immediate Market Reaction

-

Global stock indexes have fallen on rising odds of conflict — e.g., U.S. indices like the Dow, S&P 500, and Nasdaq slipped as investors grew nervous about a possible U.S. strike on Iran.

-

Financial stocks and high-beta assets tend to be hit hardest in these episodes, while defensive sectors outperform.

Why Stocks Drop

-

Geopolitical uncertainty pushes investors toward lower-risk assets.

-

Rising oil prices can hurt growth expectations, as energy costs weigh on consumer spending and corporate profits.

Volatility Measures

-

Market volatility indicators like the VIX often spike, showing fear and risk pricing well ahead of actual conflict.

Bottom line: Conflict risk = stock weakness + higher volatility.

🛢 2) Oil & Energy Markets

Supply Risk Premium

Oil markets are especially sensitive because much of the world’s crude travels through the Strait of Hormuz.

Any conflict with Iran raises fears of disruptions in this chokepoint, which handles around 20–30% of global seaborne oil.

Current Price Response

-

Brent and WTI oil prices have surged toward multi-month highs on war fears.

-

Analysts suggest prices could spike even further if Iran retaliates or blocks shipping lanes, possibly touching $80–$100 if supply routes are materially threatened.

Longer-Term Risk

If hostilities escalate and disrupt exports, even temporarily, prices could jump sharply due to the physical deficit — not just fear premiums.

Bottom line: Oil reacts immediately with sharp rallies; deeper disruption drives sustained price highs.

🪙 3) Precious Metals (Gold and Silver)

Safe-Haven Bid

Gold and silver are classic risk hedges during geopolitical stress:

-

Gold prices jump when geopolitical risk rises, as investors seek safety over risk assets.

-

Silver also tends to rally, although it’s more volatile due to its industrial demand component.

Dollar Factor

Sometimes the U.S. dollar strengthens alongside gold (as a safe haven), which can temper gold’s gains because gold is priced in USD.

Market Psychology

In conflict scenarios:

-

Flight to safe assets

-

Higher gold and silver holdings

-

Reduced exposure to stocks and crypto

Bottom line: Precious metals rise on uncertainty, with gold leading and silver reacting more sharply.

🔎 4) Cross-Asset Dynamics

| Asset | Typical Response on U.S.–Iran Conflict Fears |

|---|---|

| Global Stocks | ⬇ Fall due to risk aversion |

| Oil | ⬆ Sharp rally if supply threat rises |

| Gold | ⬆ Safe-haven buying |

| Silver | ⬆ Volatile rally |

| U.S. Dollar | ↕ Often stronger as another safe haven |

This pattern matches past geopolitical stress events, including episodes where Iran threatened shipping in the Gulf.

🧨 5) What Could Amplify or Limit These Effects

🔥 Amplifiers

✔ Prolonged conflict or retaliation

✔ Disruption at shipping chokepoints

✔ Regional spillover (Gulf states)

✔ Broader military engagement

🧊 Dampeners

✔ Quick, limited strike without broader war

✔ Diplomatic de-escalation

✔ Strategic oil releases from reserves

Analysts note that markets initially price in the worst-case scenario but can retract quickly if the conflict remains limited or short-lived.

🧠 Overall Impact Summary (Article-Ready)

If the U.S. strikes Iran or tensions escalate into sustained conflict:

-

Financial markets will instantly weaken, with stock indexes falling and volatility rising as investors reduce risk exposure.

-

Oil prices will spike, reflecting supply-chain risk premiums — especially if the Strait of Hormuz is threatened — potentially pushing Brent/WTI toward $80–$100 if disruption persists.

-

Gold and silver will rally due to their safe-haven status, though gold’s gains may be moderated by a stronger U.S. dollar as markets seek stability.

-

The overall market response will depend on whether conflict is limited or prolonged — shorter conflicts often produce sharp but temporary moves, while prolonged wars can have sustained inflationary and economic impacts.

🔐 Disclaimer

This article presents astrological research and geopolitical risk analysis for educational purposes only. It is not a declaration of certain war, not political advocacy, and not financial advice. Global events are influenced by complex human, diplomatic, and strategic decisions beyond astrological symbolism.