📉 Nifty in the Crossfire: Astrology Predicts a Steep Fall Ahead

🧭 Technical Reality Meets Celestial Warning

As of today, the Nifty 50 hovers near 24,723, showing signs of range-bound optimism. However, under the surface, the market breathes uncertainty. At the time of writing the Article the Nifty is at 24600 level at 10:30 Hrs 5th August 2025

Nearly 60% of NSE-500 stocks still trade well below their 2024 highs. With RBI policy, Q1 earnings, and Trump’s trade war rhetoric influencing volatility, financial analysts see a cap near 25,300 and critical support around 24,500.

But astrology tells a deeper, more disturbing story.

🌑 Lunation Chart of 9 August 2025: Malefic Yogas Strike

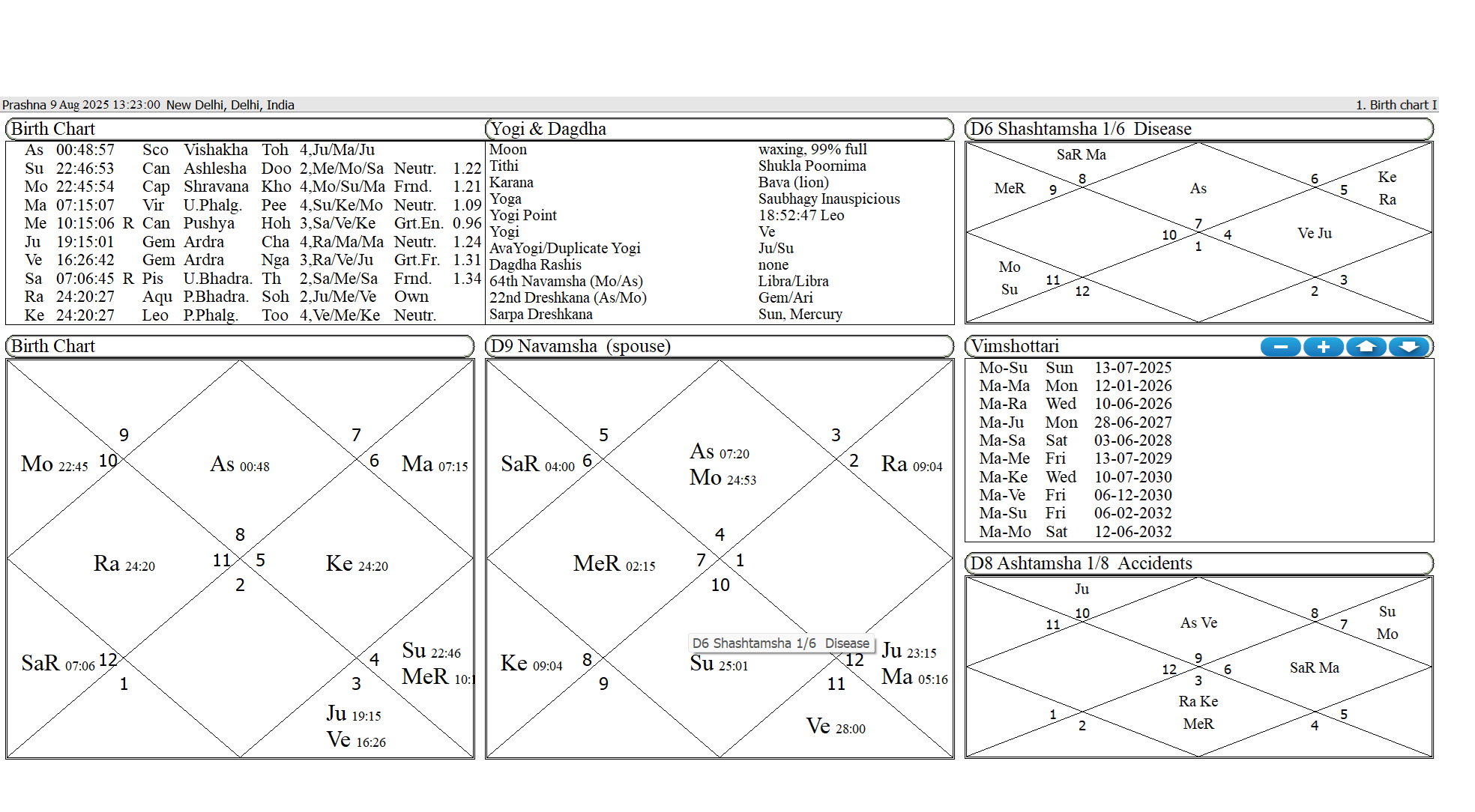

The Full Moon chart (Paksha Kundali) of 9 August 2025 at 13:23 IST, cast for New Delhi, reflects a cosmic minefield for the Indian financial markets. Three major malefic combinations come together to trigger a correction or crash in the Nifty.

🪔 The 3 Malefic Yogas Impacting the Stock Market:

| Malefic Yoga | Explanation | Impact |

|---|---|---|

| 1. Durbhiksha Yoga | Saturn retrograde + Jupiter in dual sign + Venus combust + affliction to the 2nd and 5th houses | Predicts scarcity, panic, financial contraction, historically linked with market crashes and recession |

| 2. Samsaptak Yoga at 7° | Saturn (7.18° Pisces) opposed by Mars (7.14° Virgo) = Samsaptak at sensitive degrees | Indicates sudden sell-offs, aggressive unwinding in speculative assets like stocks |

| 3. Bloodshed Yoga + Graha Yuddha | Jupiter and Venus closely conjunct in the 8th house, forming planetary war, with Venus losing | Signals loss in wealth, artistic sectors, and luxury stocks—a major drag on Nifty components like auto, FMCG, pharma |

🪙 Astrological House Analysis – Why the Fall Is Inevitable

| House | Planetary Influence | Effect |

|---|---|---|

| 5th House (Speculation) | Influenced by Saturn Retrograde from Pisces (Trikona) | Brings loss of confidence, institutional pull-out, FII selling pressure |

| 2nd House (Wealth) | Indirectly affected by Rahu/Ketu and Saturn | Causes instability in currency, liquidity concerns |

| 8th house Sudden gains

9th House (Dharma) 11th house |

Planetary war between Jupiter and Venus shortly after Lunation

Sun + Mercury retrograde → Erratic policy reactions, fear cycles Mars opposed by Saturn again |

May influence the Stock Market adversely

Saturn influencing the important houses for Speculations Stagnancy in the Speculative Market |

📉 Predicted Market Reaction (Astrological Projection)

Based on these astrological alignments:

-

The fall is likely to begin around or just after 9 August 2025

-

Trigger points may include international economic headlines, tariff war escalation, or a sudden loss in investor confidence

-

Saturn’s retrograde in 5th house is key

-

Venus loses planetary war to Jupiter = loss of speculative wealth, emotional exits, panic

📊 Estimated Nifty Levels (Based on Astrological Models)

| Period | Projection |

|---|---|

| Before 9 Aug | Sideways to mildly bullish up to 25,250–25,300 |

| After 9 Aug | Sudden dip: sharp fall between 500–800 points |

| Estimated Low | 23,800 – 23,500 possible by 16–18 August 2025 |

| Wider Window | Steep corrections expected between 9 August – 23rd August (Lunation to Lunar Eclipse shadow) |

🚨 Summary: Perfect Storm Brewing

The technical market is already weakening, and the Lunation chart warns of impending correction.

With 3 destructive Yogas forming just after the 9 August Full Moon, expect sharp, sudden declines in Nifty, particularly in speculative and luxury sectors.

The planets are aligned not for growth—but for reckoning.

Today’s Market Snapshot

-

The Nifty 50 is trading around 24,723, up approximately +0.64% from yesterday’s close . Today at 24600

-

Market breadth remains weak, with over 60% of NSE‑500 stocks still trading 20% below their 2024 highs—a warning signal on sustainability of the rally.

Near-Term Outlook

-

The upcoming RBI policy decision and fresh Q1 earnings data are expected to drive volatility; investors are advised to remain cautious

-

Expert Jay Thakkar anticipates a trading range of 24,000–25,300, with no clear directional bias yet.

-

Harshubh Shah reports a confirmed market reversal is likely around 8th August, a key cluster for intraday technical shifts.

Technical Patterns & Indicators

-

Resistance Zone: 24,800–25,000; a close above may unlock gains toward 25,250–25,650

-

Support Zone: 24,500. Falling below this level could trigger deeper selling pressure

-

Sector-wise: Metals and auto sectors are outperforming, while IT and midcaps face pressure

Risk Factors to Monitor

-

Continued FPI outflows pose a downside risk; global trade tensions (especially Trump’s tariff threats) remain overhangs

-

AA subdued global earnings season could cap upside—many analysts expect limited earnings support despite macro optimism.

Summary: What to Expect Today

-

The market is likely to open near the previous close (~24,722–24,550 with mixed sentiment

-

Expect volatile intraday swings within the 24,500–25,300 range—absorption at both ends.

-

A break above 25,000–25,300 could signal bullish momentum; a fall below 24,500 may invite panic selling.

Final Verdict

-

Outlook for today: ⚠️ Range-bound to slightly bullish, but fragile. Key hurdles lie at 25,000, while solid support holds at 24,500–24,600.

-

Focus on sectoral bread winners such as metals, auto, and select private banks.

-

A broader directional move may only materialize after clear triggers—RBI policy outcome and U.S. trade sentiment will be decisive.

-

📜 Disclaimer:

The information provided here is for educational and informational purposes only. It does not constitute financial, investment, trading, or professional advice. Stock market investments are subject to market risks. Past performance is not indicative of future results. Please consult a SEBI-registered financial advisor before making any investment decisions. The author or publisher will not be held responsible for any loss or damage arising from reliance on this information.